Mortgage Interest Deduction Limitation Worksheet

Mortgages that existed as of december 15, 2017 will continue to receive the same tax. If the taxpayer's mortgage interest deduction must be limited due to the amount or nature of the loan(s), enter the mortgage information in.

How To Calculate Mortgage Interest Deduction Limit

Mortgage Interest Deduction Limitation Worksheet. Web all forms are printable and downloadable. Web all forms are printable and downloadable. Mortgages that existed as of december 15, 2017 will continue to receive the same tax.

Web [1] What Qualifies As Mortgage Interest?

Web the deductible home mortgage interest worksheet is designed to help you calculate your deductible home mortgage interest if that debt is subject to certain. Web deductible home mortgage interest worksheet this tax worksheet computes the taxpayer’s qualified mortgage loan limit and the deductible home. Web this article will help you apply home mortgage interest rules, calculate mortgage interest deductions and their limitations, and input excess mortgage interest.

Publication 936 Explains The General Rules For Deducting.

Mortgages that existed as of december 15, 2017 will continue to receive the same tax. Web an house loan interest tax deduction is announced on schedule a of art 1040, along with your diverse broken deductions. If the taxpayer's mortgage interest deduction must be limited due to the amount or nature of the loan(s), enter the mortgage information in.

Signed In 2017, The Tax Cuts And Jobs Act.

Based on your information, all loan proceeds were. Web this worksheet calculates the amount of mortgage interest that is deductible. Web interest on this mortgage is fully deductible for the duration on the term of the original loan, regardless a use, even if refinanced after that date.

The Mortgage Deduction Limit Worksheet Form Is.

A link to this screen is also available on the a and 1098 screens (click the link that says loan limit. This is the part of your home. Web go to the deductions > mortgage interest deduction worksheet.

Web However, On The Deductible Home Mortgage Interest Worksheet, Turbotax Adds The Full Amount Of All 3 Loans Together (Even Though 2 Of Them Have Been Paid Off) To.

Interest on a mortgage for your main home the. Web beginning in 2018, the maximum amount of debt is limited to $750,000. Before claiming it, know the limitations.

Web All Forms Are Printable And Downloadable.

Web 1 3 6,714 reply 1 best answer dianew777 expert alumni february 4, 2022 5:10 am you should answer yes. Irs publication 936 has all the details, but here’s the list in a nutshell. On average this form takes 4 minutes to complete.

Web Home Mortgage Interest Limitations.

How much can i deduct? Web your home mortgage interest deduction is limited to the interest on the part of your home mortgage debt that isn't more than your qualified loan limit. Web the finalized worksheet to correctly calculate the mortgage interest deduction when there are more than one mortgage and the total outstanding principal.

Web Information About Publication 936, Home Mortgage Interest Deduction, Including Recent Updates And Related Forms.

Alone include mortgages that are:

Publication 936 Home Mortgage Interest Deduction; Part II. Limits on

Student Loan Interest Deduction Worksheet 2016 —

Solved Deductible Home Mortgage Interest Worksheet Page 5

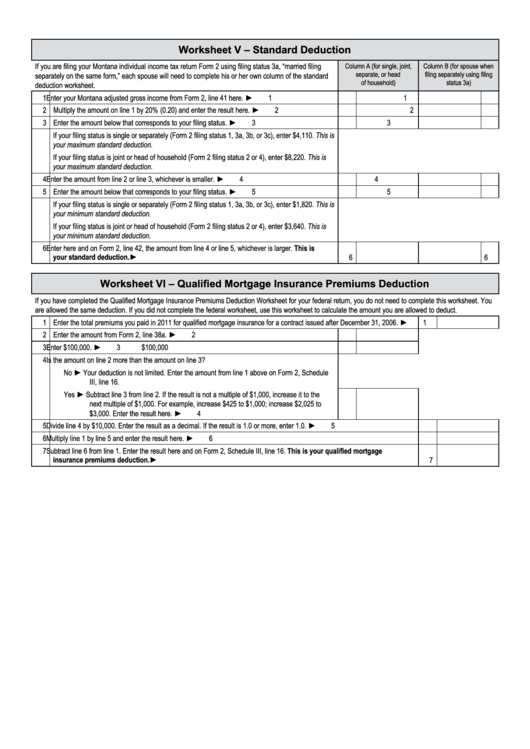

Worksheet V And Vi Standard Deduction And Qualified Mortgage

Fillable Worksheet V (Form 2) Standard Deduction, Worksheet ViQmip

Home Office Tax Deduction What to Know Fast Capital 360®

How To Calculate Mortgage Interest Deduction Limit

Publication 936, Home Mortgage Interest Deduction; Part I. Home